This post contains affiliate links. All this means is that if you sign up through my link I will receive a little bit of commission. Thanks for supporting me!

I invited my boyfriend Ryan to come back and write another financial post on the blog! He has a wealth of knowledge about investing and finance and has taught me so much since we’ve started dating. I love having him write here because I know his posts can help all of you!

Thank you to Kayla for, once again, letting me guest post! I am always talking about finance and money with Kayla and she is (sometimes) always listening. Maybe she is just letting me post this to vent all my financial knowledge to the world. I really enjoyed writing this post in 2016 and she asked me to come back and write something else for you guys.

Today I’m going to be sharing basic financial planning tips. Successful, methodical financial planning is important because it allows you the flexibility to live the life that you truly want. You should start utilizing these tools early in your life because it will give your money the best chance to grow and give you financial freedom! Here are some key steps and resources to help you begin financial planning:

1. KNOW WHERE YOU STAND TODAY!

How do we know where we are going if we don’t know where we stand today? This may be a tough question in many aspects of life, but in the world of finance, where we stand today is easily quantifiable by figuring out our net worth! Our net worth is calculated by a simple math equation:

Assets — Liabilities = Net Worth!

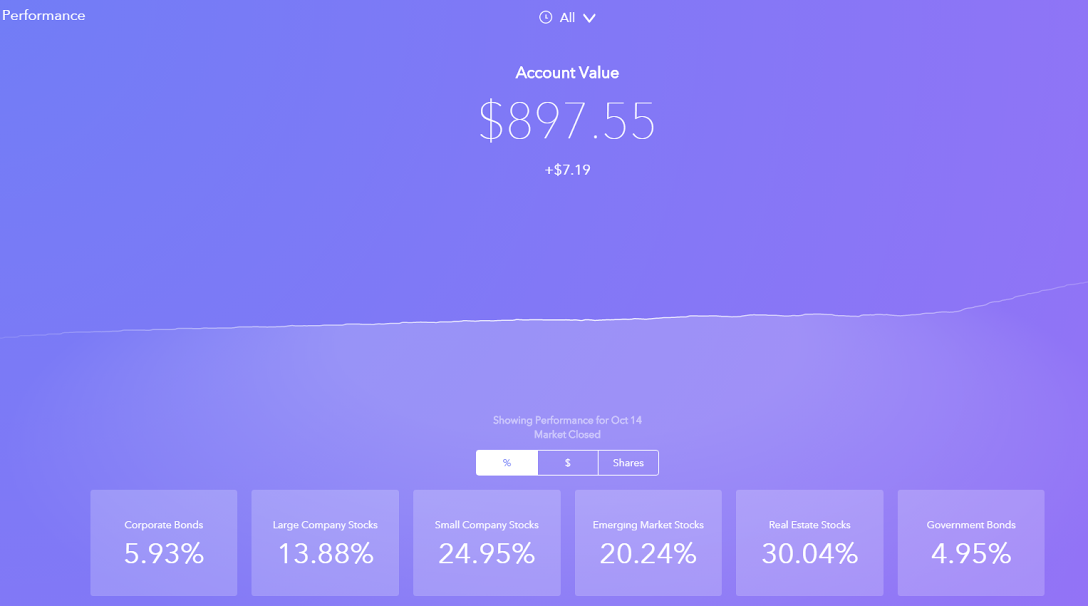

I know you didn’t come here to do math equations, so you can use Personal Capital to help you figure out your net worth!

What is Personal Capital?

Personal Capital is the second love of my life (don’t worry Kayla, we don’t have a HER situation on our hands). Personal Capital is a revolutionary website/app that actively tracks your cash, investments, debts, loans and assets absolutely 100% FREE. These things are what make up your aforementioned assets and liabilities. You can even add assets that are not tracked online such as collectibles, art, and cash in your piggy bank! If you sign up through my link and link at least one investment account, you will get a $20 Amazon gift card!

Now that you’re all signed up with Personal Capital take the time to sync all of your accounts. Are you ready to for some math? Now that you’ve synced all your accounts Personal Capital will automatically calculate and display your net worth and update it every single time you log in!

(I had you worried we would have to do some math today didn’t I? kaylablogs.com is proudly a math-free site!)

If you are sitting here staring at negative number on your screen DO NOT PANIC! You’ve already taken the very first step to quickly turning that number into a positive. You now know were you stand today.

2. BELIEVE IN YOURSELF AND DEFINE WHERE YOU WANT TO GO.

What is traditionally taught by corporations and our peers (AKA keeping up with the Joneses) is to spend, spend, and spend some more! This lead to most people becoming financially illiterate. Many “smart people” aren’t so smart when it comes to money. Finance can appear difficult and overwhelming for two reasons: (1) it’s not typically taught in schools and (2) it’s frowned upon (sadly) to discuss in our culture.

To believe in yourself and define where you want to go with your finances, you have to become financially literate. We avoided math today, but I am going to ask you do some learning! This post is great starting point, but I want to share where I acquired my financial literacy. I am constantly reading new books searching for tips, inspiration, and motivation. Here are some books I recommend for every part of your financial journey. (I promise these books aren’t filled with charts and advanced investment strategies. They are filled with simple principals, inspiration, and real life stories!)

Resources to Guide Your FINANCIAL JOURNEY

The Millionaire Next Door: This book showed me that, even over thirty years ago, average people were becoming millionaires all on their own!

Everyday Millionaires: I read Millionaire Next Door and Everyday Millionaires back-to-back to see how people achieving the millionaire status has changed. I found the change encouraging because, back then, most people achieved this status by owning a business. Today, most people are achieving this through financial discipline and education.

PART 2: How does someone get wealthy?

Total Money Make Over: You may have heard of Dave Ramsey before and will find much of what I am sharing aligns with his proven 7-step program! Check out his Podcast or YouTube channel!

Rich Dad Poor Dad: I know the cover makes it seem like a guidebook for dads but I promise it’s not! This book takes a less conservative approach to finances, but I found it super educational and inspirational. It gave me a whole new perspective on work!

Retired Inspired: It’s Not an Age, It’s a Financial Number: I don’t need to say any more than what’s in the title. Retiring requires a number but it’s not your age!

Financial Freedom: A Proven Path to All the Money You Will Ever Need: Grant Sabatier achieved financial freedom by age 30 and shares his experiences and some tips on making more money in less time. This is one of the best books I have ever read about finance.

I don’t have a book for this category yet, but once you are financially independent you can write your own book called: Doing Whatever I Feel Like Doing Every Day!

Have you read any financial books before? Let me know which one(s) in the comments. While you’re here, add me on Goodreads!

3. IDENTIFY YOUR INCOME & EXPENSES.

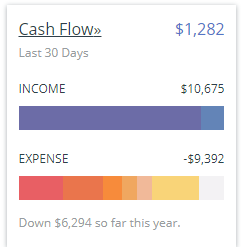

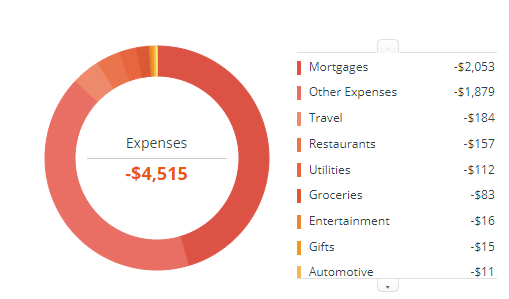

To increase our net worth, we have to talk about a little more math (sorry again) but our friends at Personal Capital have us covered again! To increase our net worth, we have to understand our cash flow. Cash flow allows us to pay off debt (reduce liabilities) and invest (increase assets).

Income – Expenses = Cash Flow

Personal Capital allows you to easily track your income and expenses each month. Before we can take the next step and create a monthly budget, we need to see where our money is coming from and what it’s going toward.

I recommend spending the first month utilizing Personal Capital and making sure your spending data is captured and categorized correctly. Capturing data on your natural spending habits before creating a monthly budget is important because setting an overly aggressive budget can make the process intimidating and un-enjoyable. It’s like trying to lose weight and wanting to lose it all in the first week. A budget is an ever-evolving process!

4. SET A BUDGET

We now know where we stand today in terms of cash flow and can utilize a budget to increase your net worth! Take time to analyze where your money is going. What is a necessity and what is a luxury? Try writing them out in a list or table.

Necessity: groceries, housing, electricity, water, transportation, insurance

Luxury: restaurants, new clothes, alcohol, vacation, electronics, concert tickets

To create a budget you need to spend ALL OF YOUR INCOME! Before you call me crazy, hear me out. By saying you need to spend all of your income, I really mean you need to give every dollar earned a purpose. Every successful business has balanced budget and so should you! To spend all of your income, you have to re-calibrate what the word “spending” means to you. Spending money can be positive! You just have to prioritize your budget. Below are four basic categories for budgeting:

1. Necessities

2. Debt/Extra Debt Payments (seriously… pay off those loans and never take on any more debt!)

3. Investments

4. Luxuries

You can utilize the budget feature of Personal Capital, make your own excel sheet, or try out some other great FREE budgeting sites/apps like EveryDollar or MINT.

5. MAXIMIZE THE BUDGET – WHEN YOU MUST SPEND, SPEND WISELY.

You’ve now given every dollar a purpose, but you must wisely guide your dollars. Here a few tips I use to maximize my budget:

1. Wait for 24-48 hours before making any purchase. Kayla taught me a great technique where we go to a website and fill up our cart with every item we could possibly want from the store. But instead of buying all the items in our cart, we leave the cart (don’t worry, this is an online technique and we just hit the big ole red x). We then come back later and see how we feel about the items we wanted to buy. Is it in the budget? Do we still feel the need to purchase it?

2. Save money where you can. When I do finally decide to purchase something, I check if EBATES is offering cash back. EBATES is website/app that offers a great percentage of cash back for shopping at your favorite stores. They even have a chrome browser extension. I’ve used EBATES to earn cash back on hotels, airfare, clothes, and much more! I’ve earned over $250 in cash back since signing up for EBATES. Get $10 instantly for free when you sign up!

6. KEEP INVESTING (OR START!)

You’re maximizing your budget and, because you’ve given every dollar purpose, you now have more cash flow than ever before! What should you do with that extra cash flow? Let’s budget that extra cash flow towards my favorite spending category, INVESTMENTS!

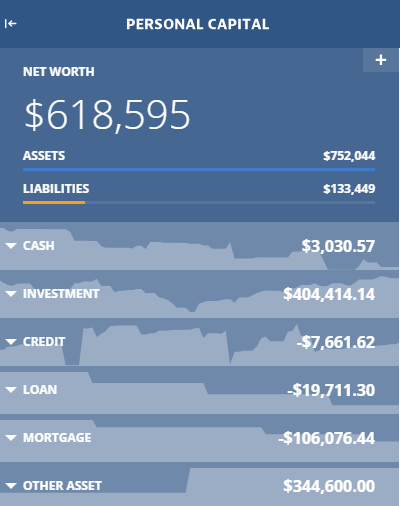

Many people believe investing is complicated or requires large amounts of money (Kayla used to think this). That is certainly an old MYTH. Modern day investing has become more simplistic, accessible, and automated than ever before. Below are some apps that I have used to get the ball rolling in my own life:

ACORNS

To start investing with Acorns, all you have to do is link your debit and/or credit card. Every time you swipe your card Acorns will round your total to the next dollar and invest the extra money for you. So if you spent $4.35 on Starbucks even though you’re trying to stick to a budget? Boom. That $4.35 is rounded to $5.00 by Acorns and $0.65 cents invested into your Acorn account! If you sign up through my link we will both get $5 for free to invest!

ROBINHOOD

Robinhood is a fantastic mobile app that allows you buy and sell investments with ZERO trade or account fees. If you sign up for Robinhood you’ll be gifted a free stock at random! Who wouldn’t want to start off their portfolio with a free share of Apple, Microsoft, or General Electric?

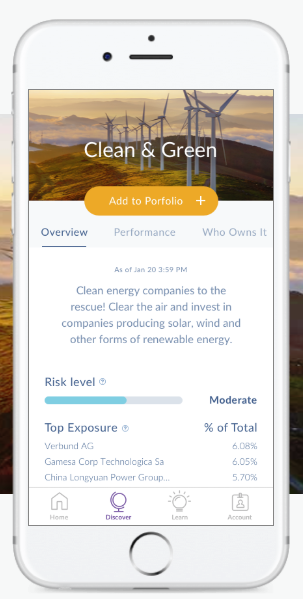

STASH

Having a hard time choosing what to invest in? Invest in what you are passionate about! Stash offers pre-designed portfolio options that focus on the investors interest. Social Media Mania, Clean & Green, Do the Right Thing, and Water the World are just a few of the handful of funds offered through Stash. Sign up for STASH and receive $5 free towards your first investment!

7. REVIEW YOUR BUDGET EACH MONTH

On the last day of the month, take 10 minutes to have a budget meeting with yourself to see where you excelled and where improvements can be made. In the same meeting, look forward to the next month and adjust your budget accordingly. Is your income changing? Are there any new expenses you are going to incur? Having a budget meeting each month will significantly increase your cash flow allowing you to pay off debt, invest, and ultimately increase your net worth! You’ll thank yourself later.